April 26, 2023

Government DebtPublic debt of Kazakhstan: Results of 2022

One of the priorities of the Government is the planning and management of the state budget. In Kazakhstan, the expenses are mainly covered by tax and non–tax revenues and transfers from the National Fund, and the rest at the expense of borrowed proceeds.

Thus, public debt is money that the state borrows to cover its expenses. These funds are mainly allocated for the development of key economic and infrastructure sectors. Also, borrowed money is used to solve issues of social needs, such as healthcare, education, social assistance and provision.

The public debt can be divided into two parts by structure - internal and external. Debt to other countries, foreign organizations and private investors is an external debt, and debt to domestic companies and investors is an internal debt. The latter also includes obligations to its citizens.

Current situation

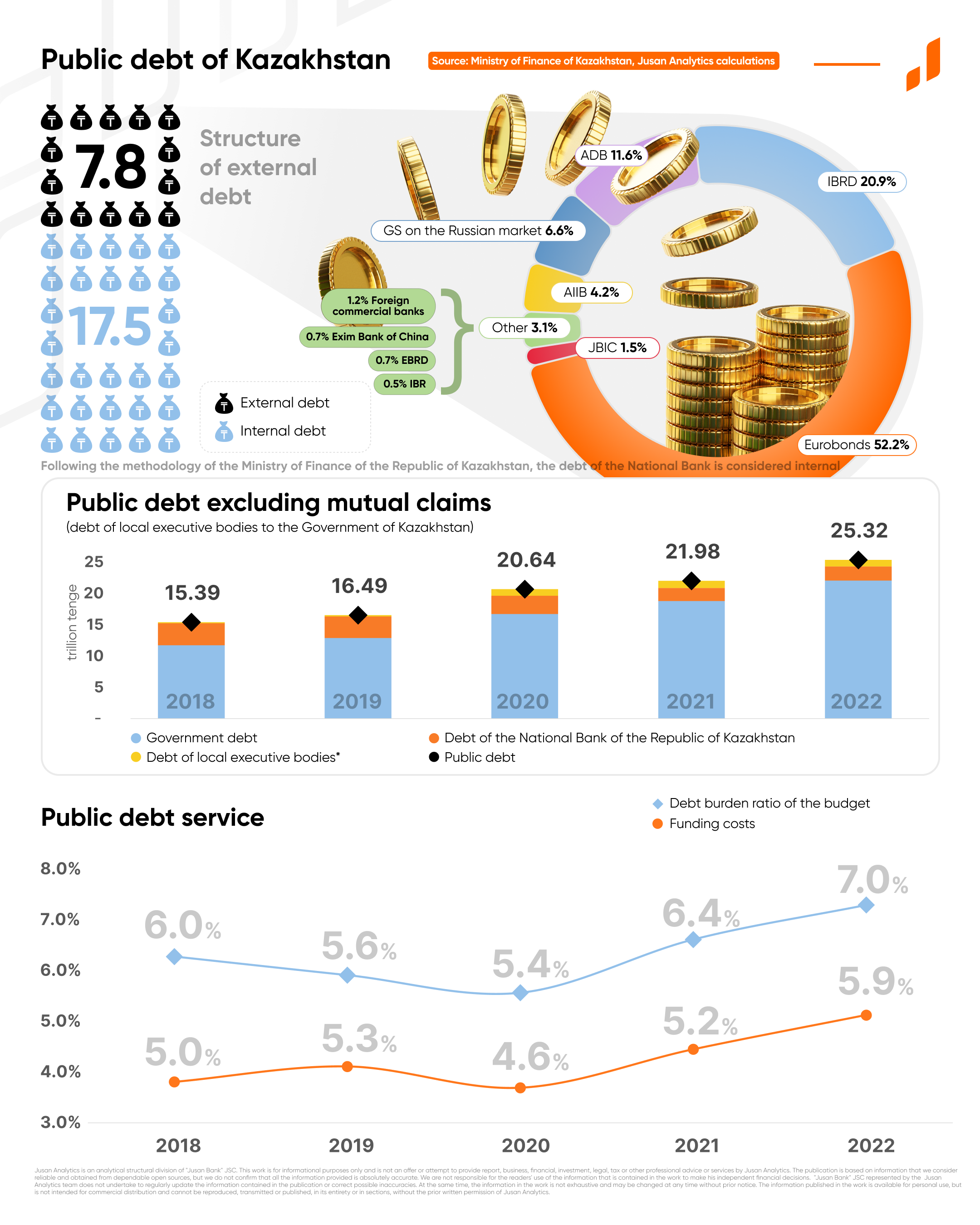

In recent years, especially during the corona crisis, the Government has increased the volume of borrowing. Kazakhstan's public debt increased by 15.2% and amounted to 25.3 trillion tenge (or $54.7 billion) in 2022, which is 24.9% of GDP.

Worth noting is that most of Kazakhstan's public debt - 66% on average over the past 5 years - is accounted for by internal debt, which is more manageable and less risky. Its share increased to 69% in 2022, and the debt amounted to 17.5 trillion tenge ($37.8 billion).

According to the results of last year, the volume of external public debt reached 7.8 trillion tenge ($16.9 billion). More than half of the borrowings were obtained by issuing Eurobonds. The economy of Kazakhstan is also actively financed by international organizations.

With the growth of public debt, the costs of servicing it also grow. In 2022, they amounted to almost 1.3 trillion tenge, 32.7% more than in 2021. This became the 5th largest item of expenditure of the Republican budget - about 7% of all budget expenditures.

The share of debt servicing costs from the total amount of debt on average over the past 5 years is only 5.2%, which indicates a fairly cheap funding cost.

Following the Ministry of Finance of the Republic of Kazakhstan for 2022, the structure for the payment of the state debt of Kazakhstan is as follows: 78% have a fixed interest rate, 17% have a floating interest rate and only 5% of loans are indexed to inflation.

Our and their public debt

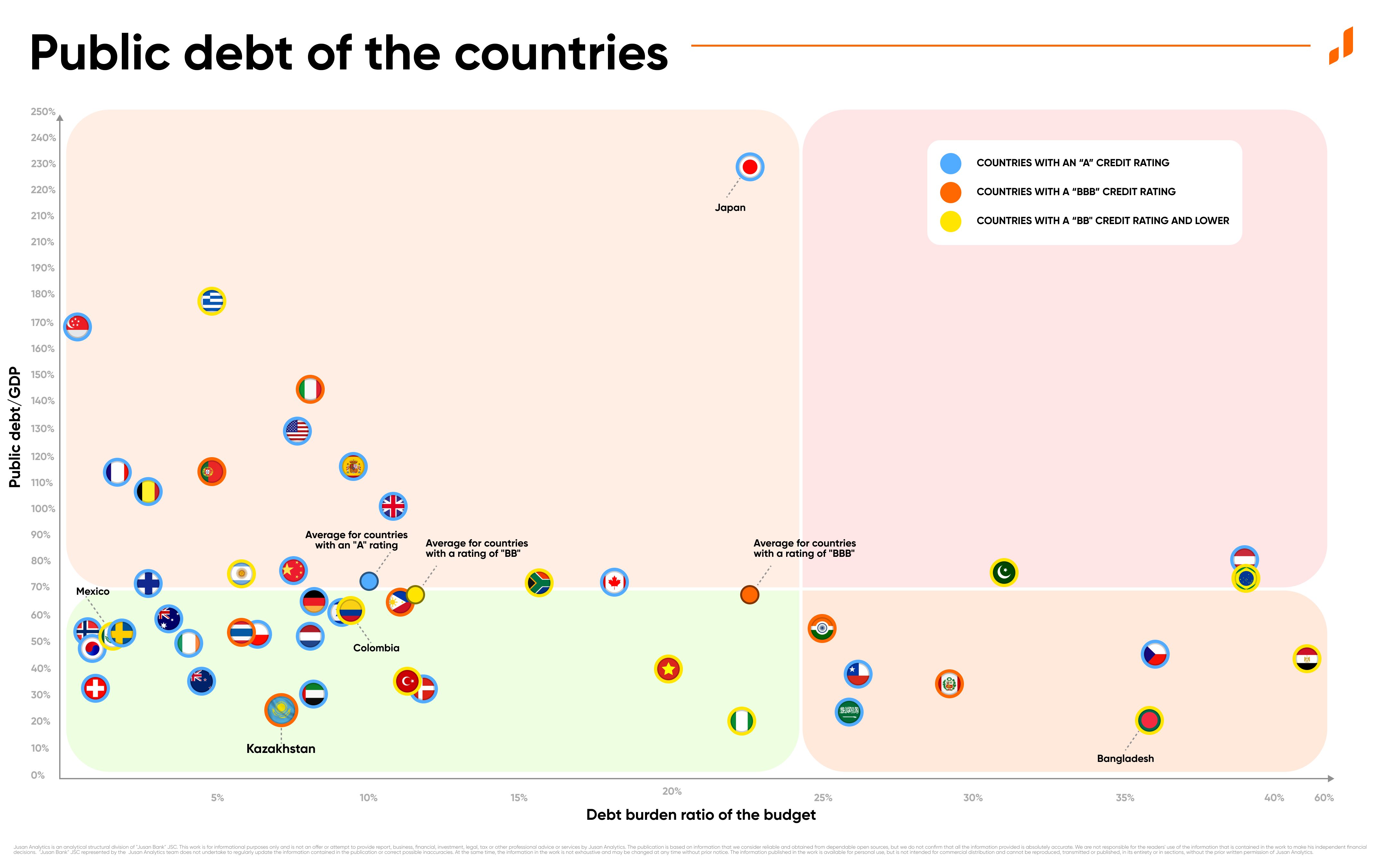

To understand whether we have a large public debt, we decided to compare it with the indicators of other countries. The sample included 46 countries of the world, the total GDP of which is more than 90% of the world.

We divided the countries into 3 main groups as a comparison:

- countries with an "A" credit rating,

- countries with a "BBB" credit rating,

- countries with a "BB" credit rating or lower.

The credit rating reflects the attractiveness of the country for investments. So, the "A" rating includes the most solvent countries, and the "C" on the contrary. At the same time, it is considered that all countries that fall under the rating below "BBB-" trade speculative bonds and are risky for investors. Thus, our division proceeded from the fact that countries with a similar rating would have approximately the same cost of attracting external borrowing and the same amount of risks for investors.

It is necessary to use various indicators and metrics to assess the level of debt burden and possible risks. We used 2 following approaches in our analysis:

- Compared the ratio of public debt to GDP and the debt burden ratio (i.e., the size of the public debt and budget expenditures for its servicing);

- We have built a Debt Sustainability Index calculated as a geometric weighted average of the two mentioned above indicators and 5-year credit default swaps for bond issues of the countries (CDS).

The public debt and its servicing costs

According to World Bank research, the value of public debt to GDP exceeding 77% can negatively affect the country's economy. At the same time, each percentage point of debt above this level costs countries 0.017 percentage points of economic growth. This phenomenon is even more pronounced in emerging markets, where every additional percentage point over 64% per year slows growth by 0.02%.

Nevertheless, given that the state authorities set the maximum possible values, the level of public debt is significantly higher in many countries. Thus, the total public debt in developed economies exceeded 100% of GDP back in 2011 and has not decreased since then (now it is about 118%). Public debt averages just over 60% in developing countries and emerging markets.

A significative parameter of the debt burden can be the volume of annual payments on public debt, the so-called "debt load coefficient". The level of debt service costs depends both on the size of the debt itself and on the term and funding costs. On average, Governments of developing and developed countries have spent about 10% of their budget expenditures on public debt repayment in recent years. In our opinion, higher expenses (25% or more) may already signal an increased debt burden.

As can be seen from the infographic, among the countries with a high country rating, Japan (229.1% of GDP), Singapore (167.8%) and the United States of America (129.1%) have high public debt. Creditors are more willing to invest their funds in the instruments of these countries. On average, this group of countries spends about 10% of budget expenditures on debt servicing. The exceptions are Austria (39.0%), the Czech Republic (36.0%), Chile (26.1%), Saudi Arabia (25.9%) and Japan (22.6%).

Public debt over 100% is registered in Italy (144.7%) and Portugal (113.8%) in category 2. At the same time, Kazakhstan has the lowest level of public debt in this category – only 24.9% of GDP. The highest debt service costs are in Peru (29.2%) and India (25.0%), the average for the group is 12%. These expenses amount to 7.3% in Kazakhstan.

In category 3, Greece (178.2%) and Nigeria (20.2%) occupy the first and last place by public debt. Given the low credit ratings, servicing the public debt of these countries is more expensive – about 23% of all budget expenditures on average. In this category is a country whose debt service accounts for more than half of the budget – Egypt (54.0%). More than 30% of debt expenditures are recorded in Brazil, Bangladesh and Colombia.

Debt Sustainability Index

The Debt Sustainability Index comprehensively reflects the situation with the debt burden. Thus, a high level of debt to GDP cannot be unambiguously interpreted as the presence of significant problems in the country. The most striking example is the indicator of debt to GDP in the United States of America. In our view, the great importance of debt with a low level of payments and a high assessment of investors on its possible refinancing negates the negative.

We also note that according to the calculation methodology, each of the three factors has equal weight in the Index value.

- The ratio of public debt to GDP shows the degree of the total debt burden of the country. 77% of GDP was chosen as the threshold value.

- The debt burden ratio of the budget shows the share of payments on public debt from total budget expenditures. A high share, even with a relatively small debt, means difficulties in servicing it and the impossibility of freely manoeuvring fiscal policy. Public finances are starting to work on servicing creditors. In our opinion, debt servicing costs exceeding 25% of the total budget expenditures already indicate the presence of serious problems.

- The value of 5-year credit default swaps shows the assessment of the market and investors of the country's stability, as well as the level of demand for insurance against a possible default. Also, this indicator indirectly characterizes the country's ability to further issue or refinance debt at current interest rates. The value of CDS over $200 is already a serious factor that gets one thinking about the attractiveness of investing in debt and further maintaining external financing of a specific country.

The Index value above 100 means that the country has extremely high risks of debt sustainability loss, 100-75 is active risk growth. At the same time, countries with a value less than 50 are characterized by a low-risk level of debt sustainability.

According to our analysis, Pakistan, Egypt, Argentina, Brazil and Nigeria have the highest debt burden and high investment risk. A reliable rating is noted in 25 countries, including Kazakhstan.

All in all

According to the indicators considered, Kazakhstan's public debt is one of the lowest in the world, even taking into account the IMF outlooks that Kazakhstan's public debt will grow and reach 30.3% of GDP in 2027. According to our assessment, such growth does not have any negative consequences and will remain relatively low. At the same time, we believe that the issue of maintaining high budget revenues to cover the expenditure and keeping the optimal level of state reserves to maintain the status of a net creditor remains more significant for the country.

The recent revision of the S&P Global Ratings outlook for Kazakhstan's sovereign credit ratings from "Negative" to "Stable" suggests that the situation in the domestic economy is gradually stabilizing and that there is a decrease in uncertainties, which leads to an increase in the country's investment attractiveness and the possibility of obtaining loans on more favourable terms.

Klara Seidakhmetova

Senior AnalystApril 26, 2023

Government DebtSign Up for the Most Helpful Mailing List