Publications by topic Ex-rate

06 April 23

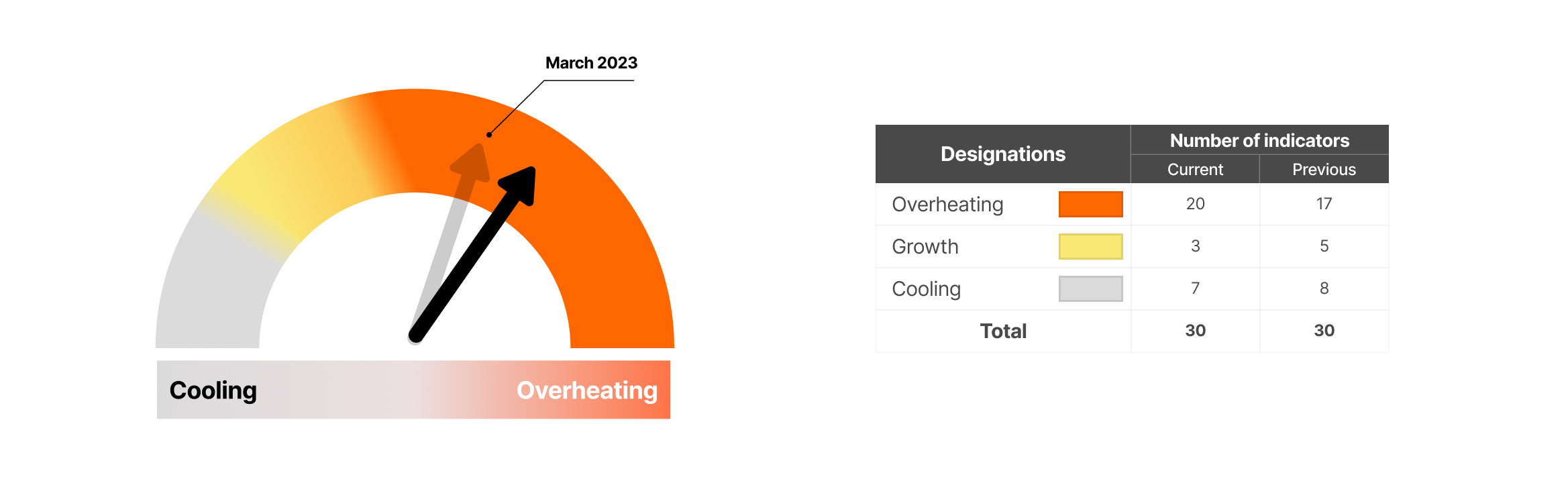

Dashboard for assessing current economic activity (04/06/2023)

According to the dashboard results for December, 21 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Thus,2 indicators in the monetary conditions block and 1 indicator in the economic environment block have crossed the overheating zone compared to the previous dashboard. We also note an improvement in business activity while reducing the increase in consumer prices in March. Inflation rates fell due to the technical effect of a high base, without identifying other fundamental factors that could have a disinflationary effect. At the same time, the risks of inflationary environment deterioration have significantly increased that are related to the allocation of additional funds to support business activity, which for the most part causes excessive demand, as well as imbalances accumulated over the years of administrative restrictions in the housing and utility services and fuel market.

So, in terms of growing business activity, prolonged geopolitical risk, mini-crises in the US and EU banking systems and the deterioration of prerequisites for the inflationary processes, the regulator will continue its hawkish policy till the middle of the year, which determines our expectations for maintaining the base rate at the same level at the upcoming meeting – 16.75%.

Periodic Researches

23 February 23

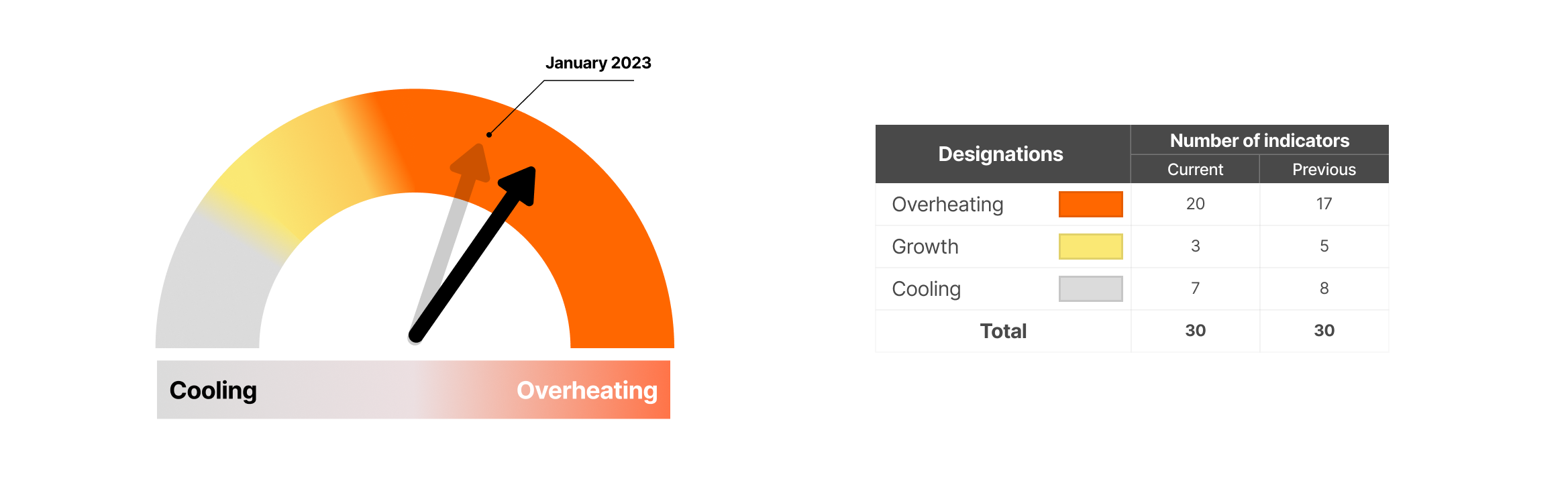

Dashboard for assessing current economic activity (02/23/2023)

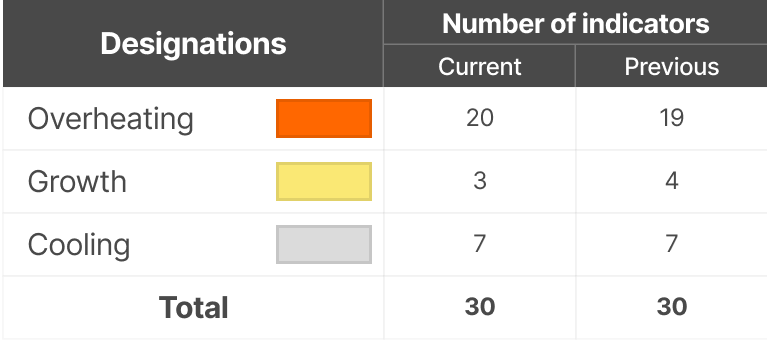

According to the dashboard results for December, 20 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Compared to the previous dashboard, 1 indicator in the monetary conditions block and 2 indicators in the economic environment block have moved to the overheating zone. Due to a significant acceleration of economic activity, while maintaining a positive increase in prices, there was an increase in overheating in the economy in January 2023. This development of the economy is mostly due to the recovery growth of the sectors affected last year.

We believe that the balance of current indicators corresponds to some softening of the inflationary background due to the easing of consumer demand pressure. Unstable and high inflation expectations, the continued growth of underlying inflationary pressure and the persistence of increased fiscal incentives that largely support consumer activity explain the predominance of pro-inflationary risks. In this regard, we expect the base rate to remain at the current level and the regulator to maintain hawkish rhetoric in general even after the reversal of the inflationary trend.

Periodic Researches

12 January 23

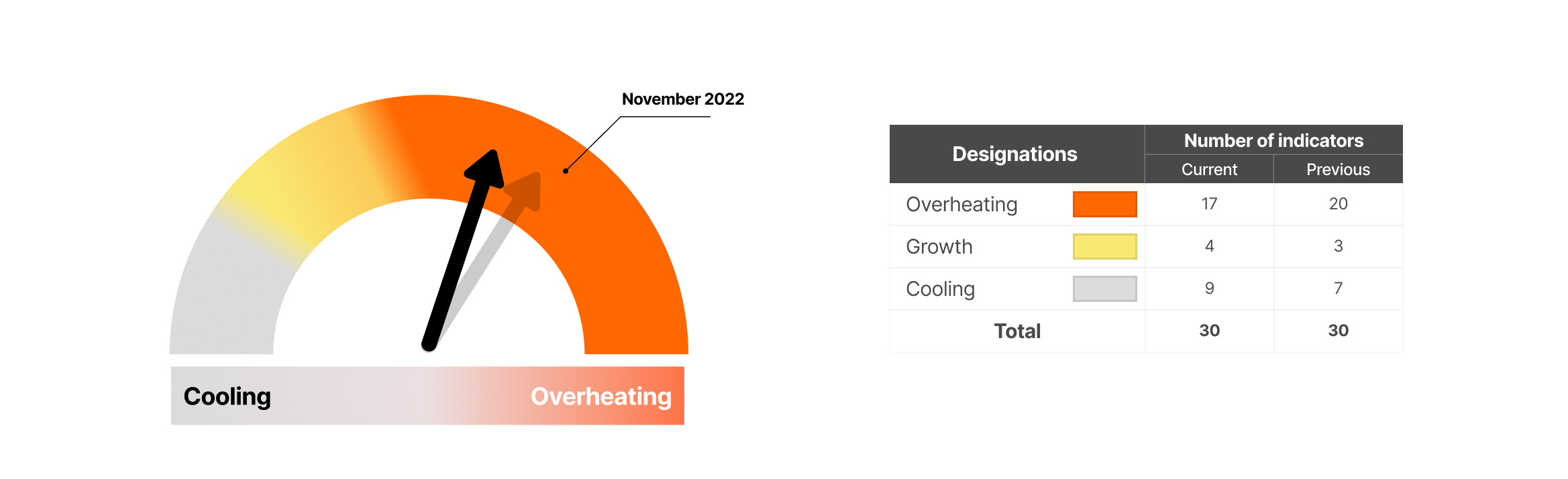

Dashboard for assessing current economic activity (01/12/2023)

According to the dashboard results for December, 17 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Compared to the previous dashboard, 1 indicator in the monetary conditions block and 1 in the external conditions block have moved into the cooling zone. Due to the tightening of internal monetary conditions and the mitigation of the negative impact of the external inflationary background, there is a slight weakening of the price overheating in the economy in December 2022. And we note a positive increase in economic development for the first time since the last spring.

We believe that a further increase in interest rates can only deepen stagflationary risks in the current conditions. Keeping the base rate at the current level will help maintain a balance between limiting further price growth and maintaining positive business activity dynamics.

Periodic Researches

02 December 22

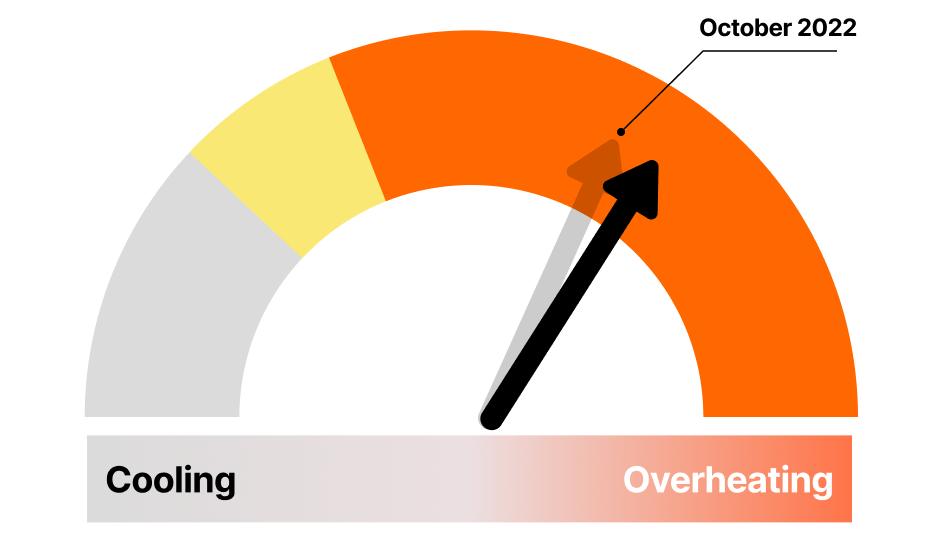

Dashboard for assessing current economic activity (12/02/2022)

According to the dashboard results for November, 20 out of 30 factors indicate an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

1 indicator in the inflation block has moved into the overheating zone in comparison with the previous dashboard. The increase in price factors overheating is getting worse, while business activity and economic growth, on the contrary, show cooling. Increasing stagflation risks are likely to be a factor in maintaining budget spending at elevated levels. In these circumstances, an excessive increase in interest rates may contribute to an additional expansion of the budget deficit, thereby complicating the ability to keep inflation under control. Given the growing risks regarding the prospects for the development of the domestic economy, the main issue in ensuring sustainable growth and stable inflation is a balanced approach to decision-making, as well as the consistency of budgetary and monetary policy measures.

Periodic Researches

12 October 22

Dashboard for assessing current economic activity (10/12/2022)

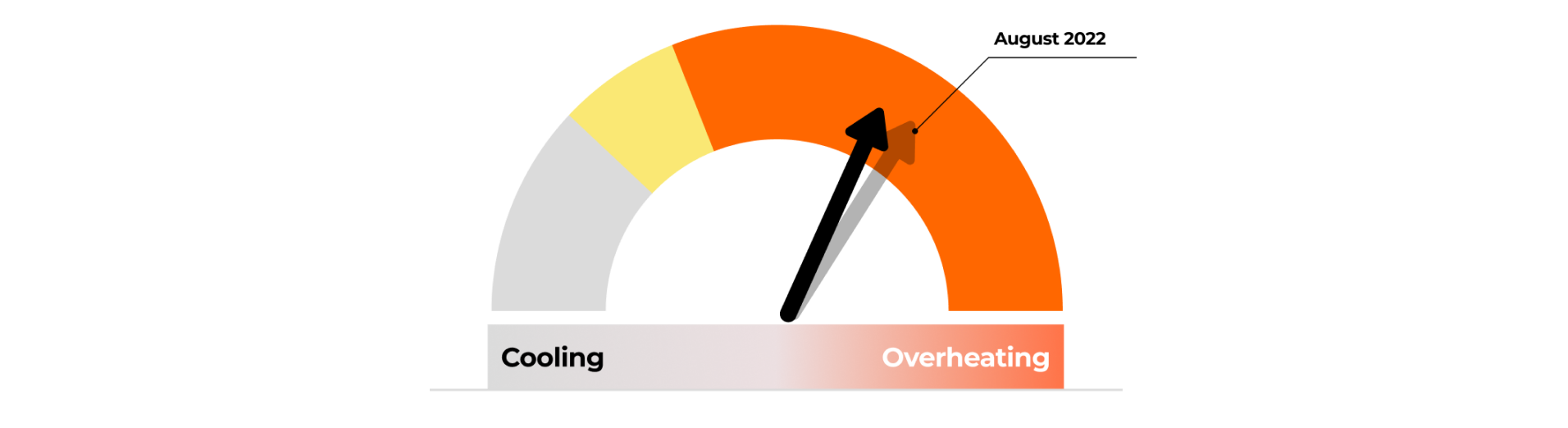

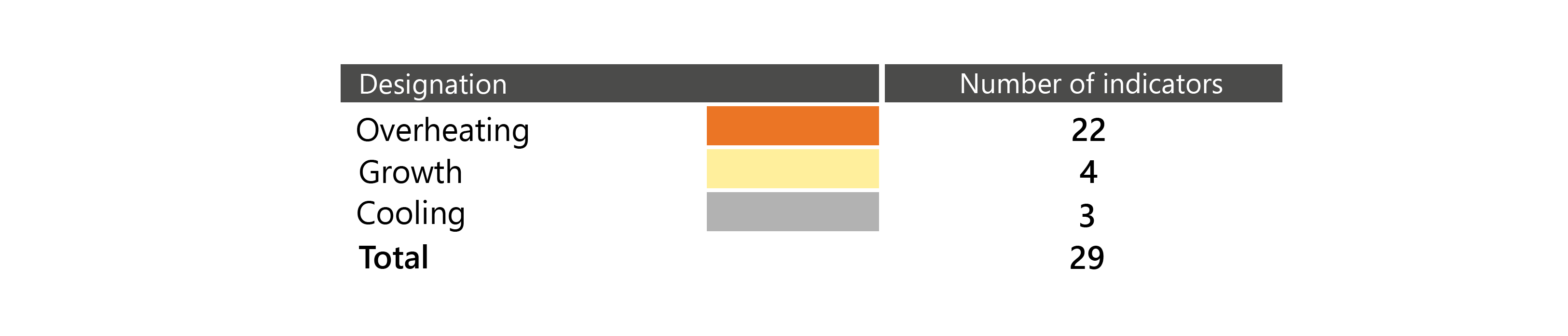

According to the dashboard results for September, 18 out of 29 factors indicate an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

1 indicator in the inflation block and 2 in the economic conditions block have moved into the cooling zone compared to the previous dashboard. Price factors for the period under review show an increase in overheating, while indicators of business activity demonstrate cooling. Thus, there is an imbalance between supply and demand when the latter does not have time to respond to the corresponding fiscal and credit incentives. And in these conditions, it is necessary to focus on the point factors of excess demand: consumer lending and non-scalable fiscal motivation. Further monetary tightening may lead to an asymmetric and undesirable effect, when supply may shrink more, and demand does not react as appropriate.

Periodic Researches

02 September 22

Dashboard for assessing current economic activity (09/02/2022)

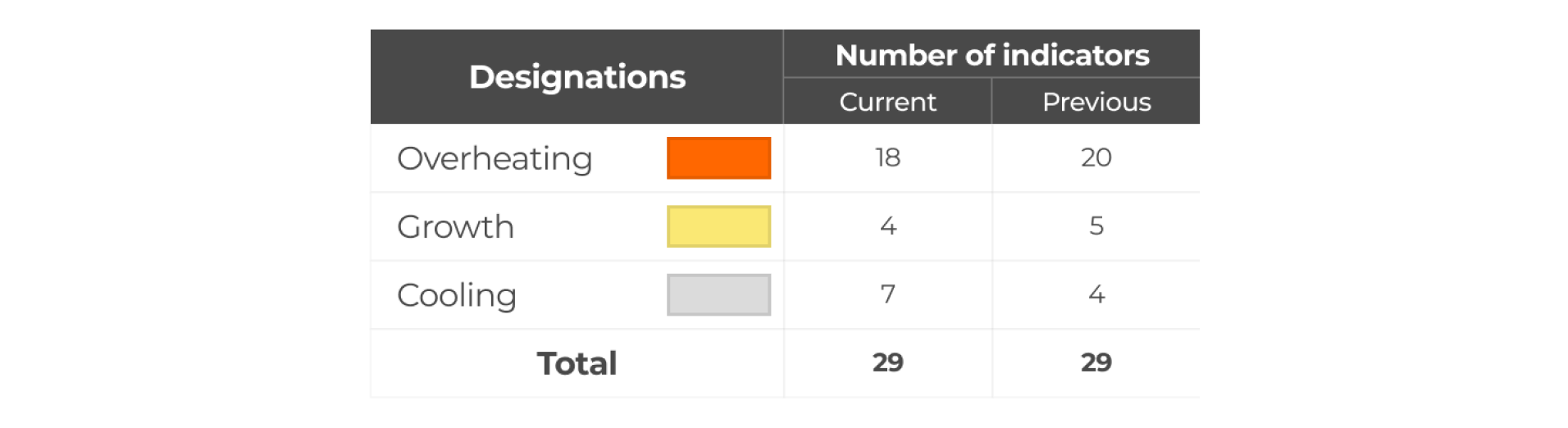

According to the results of the developed dashboard, 22 out of 29 factors indicate a steady overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

1 indicator in the inflation block and 2 in the monetary terms block have moved into the cooling zone compared to the previous dashboard. However, the increased overheating in the previously observed indicators brings the attention of the Government and the National Bank of the Republic of Kazakhstan to continue assuming measures to stabilize the situation. We expect a further increase in the base rate at the next meeting of the National Bank of the Republic of Kazakhstan Monetary Policy Committee.

Periodic Researches

21 July 22

Dashboard for assessing current economic activity

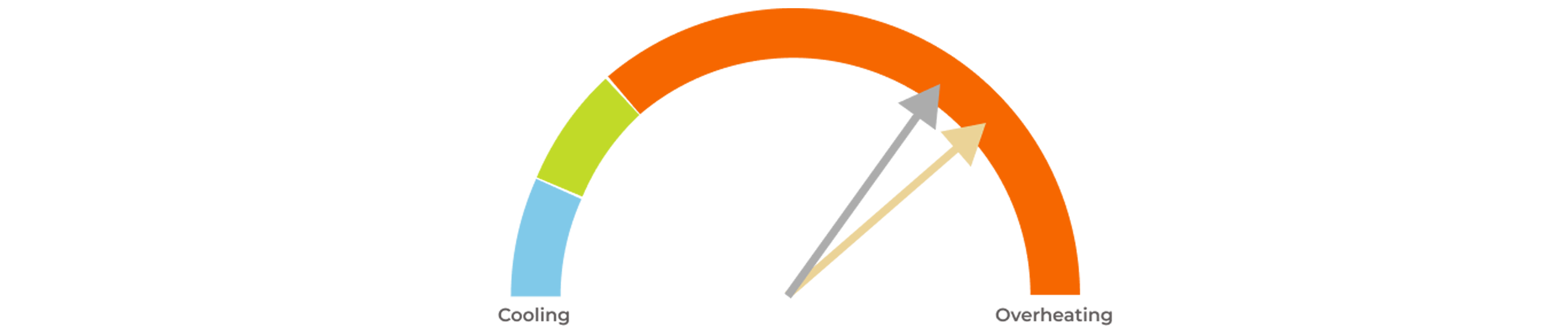

Jusan Analytics team has developed a dashboard for assessing current economic activity

The dashboard allows you to understand what phase of the short-term cycle the economy is in, as well as predict the likely actions of economic agents (inflation, exchange rate, business activity, rate).

According to the results of the developed dashboard, 22 out of 29 factors indicate a steady overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the press release of the National Bank of Kazakhstan was also carried out.

It is necessary to take appropriate measures to stabilize the situation. We expect an increase in the base rate at the next meeting of the National Bank of the Republic of Kazakhstan Monetary Policy Committee. At the same time, the number and stability of the overheating areas indicate the need for a more drastic increase in the rate.

Periodic Researches