Publications by topic Business

07 August 23

Leading indicator of economy (6 months of 2023)

According to the data for the first half of the year, the economy grew by 5%, while the short-term economy indicator - by 5.6%. The widening of the difference between the short-term economic indicator and GDP data occurred as a result of the economic downturn in professional activity fields, real estate transactions and public administration and defence. Cyclical industries continue to be the main economic drivers, growing by double-digit values due to the increased government spending, growing consumer activity and the implementation of infrastructure modernization plans. We expect these industries to continue to maintain high growth rates.

The industrial sector also has an additional positive impact on the economy. Thus, the mining industry grew by 15.4% compared to June last year as a result of the base effect. Considering that last year the problems at CPC and Kashagan continued until November, we should expect the development of this industry at high levels by the end of the year.

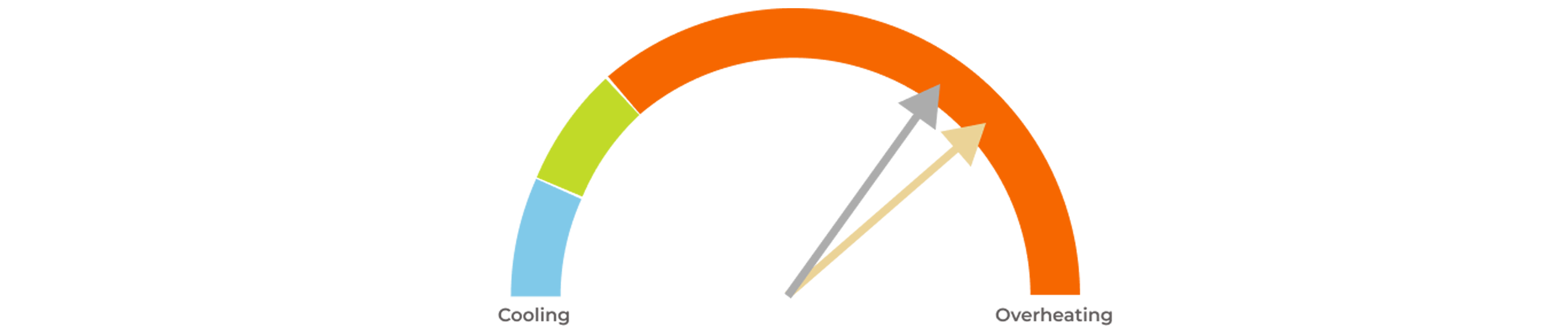

Thus, the previously observed trends persist and the economy continues to be in the overheating zone.

Given the above, we expect the economy to maintain high growth rates in the range of 4.7-5.0% next month, followed by a slight decline to 4.5-4.8% at the end of the year. This will also be affected by improving business conditions, good demand for goods and services from the population, a boom in the construction industry and a stable situation in foreign markets.

However, there are still risks from the deterioration of the geopolitical situation, falling oil prices due to insufficient demand and accelerated price growth within the country.

We expect annual economic growth at the level of 3.9-4.2% from 2024. One of the main engines of such growth will be the hydrocarbon sector due to the expansion of oil fields and an increase in oil production, alternative routes in supply chains, as well as the introduction of new production facilities as part of the national development plan implementations.

BusinessKlara Seidakhmetova

06 April 23

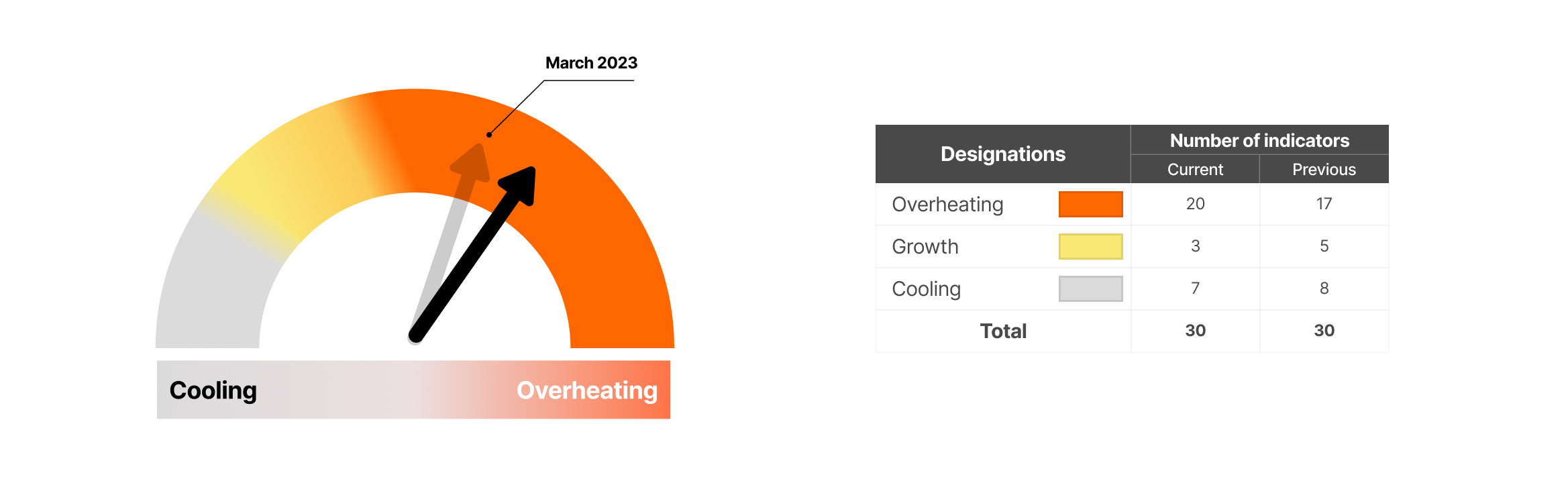

Dashboard for assessing current economic activity (04/06/2023)

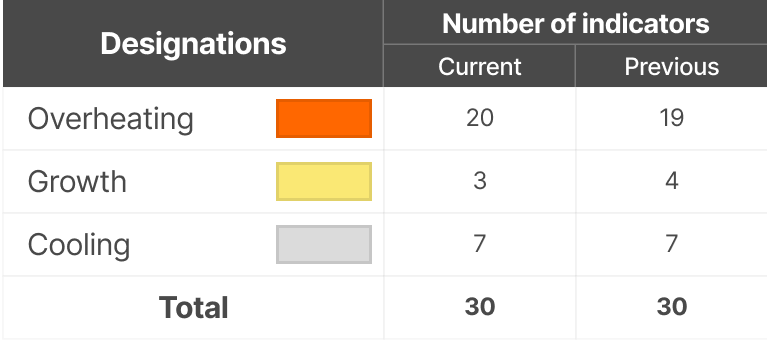

According to the dashboard results for December, 21 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Thus,2 indicators in the monetary conditions block and 1 indicator in the economic environment block have crossed the overheating zone compared to the previous dashboard. We also note an improvement in business activity while reducing the increase in consumer prices in March. Inflation rates fell due to the technical effect of a high base, without identifying other fundamental factors that could have a disinflationary effect. At the same time, the risks of inflationary environment deterioration have significantly increased that are related to the allocation of additional funds to support business activity, which for the most part causes excessive demand, as well as imbalances accumulated over the years of administrative restrictions in the housing and utility services and fuel market.

So, in terms of growing business activity, prolonged geopolitical risk, mini-crises in the US and EU banking systems and the deterioration of prerequisites for the inflationary processes, the regulator will continue its hawkish policy till the middle of the year, which determines our expectations for maintaining the base rate at the same level at the upcoming meeting – 16.75%.

Periodic Researches

27 March 23

Leading indicator of economy (2 months of 2023)

According to the results of 2 months of 2023, the growth of the short-term economic indicator slowed down and amounted to 4.0%

A slight cooling occurred due to a slowdown in the growth of the service sector from 7.6% to 5.0%. And the goods production sector, on the contrary, grew from 2.3% to 2.7%.

The main sectors of the economy continued to develop in positive dynamics, while a slight decrease in growth rates was noted in the communication, wholesale and retail trade, transportation and warehousing, as well as in the mining sector.

The construction has shown the greatest growth of 12.8%. Construction of residential buildings in January-February decreased by 11.8%. At the same time, the construction of non-residential buildings increased by 35.4%, which blocked the negative impact of the housing part. The construction of structures increased by 5.3%. The growth is due to an increase in investments in fixed assets by 19.3% (last year +2.6%), the delivery of construction projects and continued state support.

The growth rate accelerated to 3.9% in the agricultural sector due to the increased production of the main types of livestock products by 4.1%.

A questionable matter was noted in the industrial sector, which grew by 1.6%. A slowdown in growth was observed in the mining industry from 1.2% to 0.5%. A decrease in comparison with last year is noted in the production of coal (-15%) and iron ores (-29.8%). The negative effect was offset by the extraction of non-ferrous metals (+7.6%) and other minerals (+12.9%). At the same time, crude oil and gas production remained at the level of last year, which, in our opinion, is due to the problems with the oil shipment to the CPC.

The growth of the Industrial Production Index was 2.5% in the manufacturing industry. The growth was thanks to the accelerated production of textiles (+54.1%), electrical equipment (+48.7%), light industry (+34.3), mechanical engineering (+31.5%) and beverages (+22.6%). The decrease occurred in metallurgical production (-11.3%) and tobacco production (-2.6%).

The cooling in the services sector was due to a slowdown in the growth rates of the main industries, which was expected after the “peak” values of January.

Thus, the growth in the communications market slowed from 18.1% to 12.0%, trade – from 19.4% to 11.5%, and transportation and warehousing industry – from 8.0% to 6.1%.

The communications industry is growing due to Internet services (+22.3%) and television (+16.5%), the development of which is supported by government programs and plans.

A decrease in growth rates was observed in retail and wholesale trade. At the same time, the main negative impact on retail continues to be food products, the decline of which has deepened to -5.5%, and this continues to happen due to a drop in real household incomes and a significant increase in prices. The wholesale segment demonstrates a more stable growth in sales of both food and non-food products.

In the transportation and warehousing industry, good rates were noted for passenger transportation (+19.0%) and passenger turnover (+33.8%). As a result, the revenues of enterprises from transportation amounted to 738.0 billion tenge.

Periodic Researches

10 March 23

Leading indicator of economy (January 2023)

The Short-term Economic Indicator showed solid growth and amounted to 5.0% in the first month of 2023.

Such accelerated development was provided by the growth of the real sector (+2.3%) and the service sector (+7.6%). Positive dynamics were observed in all major sectors of the economy, while the main contribution to its growth was made by the service industries: wholesale and retail trades, as well as the communications industry. If we consider the real sector, then the greatest growth was observed in construction.

According to data for January 2022, industry grew by 1.4%. The mining industry moved into the growth zone and amounted to 1.2% (7.2% in January 2022) for the first time since October last year. This growth was provided by the production of oil (+1%), non-ferrous metals (+9.1%) and other minerals (+7.6%). However, there was a decrease in coal and iron ore production continued compared to last year.

The Gross Value Added of the manufacturing sector increased by 1.6% as a result of an increase in the production of pharmaceutical products (+51%), food (+9.8%), beverages (+33.2%), textiles (+25.5%), tobacco products (+21.3%), and mechanical engineering (+12.1%). At the same time, there is a decrease in clothing (-13.8%) and metallurgical production (-7.4%).

The construction industry showed an impressive increase of 12.5%. In January, the construction of residential buildings decreased by 31.5% compared to the same period last year, and, on the contrary, non-residential buildings increased by 39.1%, which blocked the negative impact of the housing part. Construction of structures increased by 14.4%. In our opinion, this was due to increased investment in fixed assets, delivery of construction projects and continued government support of the industry.

All major industries in the real sector showed good growth.

Thus, the growth in the communications market was +18.1%, and in trade +19.4%: the retail sector grew by 20.8%, and wholesale – by 18.8%.Such accelerated growth of industries is explained by the last year’s low base effect due to the January events. At the same time, the development of the communications industry is supported by the state through national projects to provide citizens with high-quality Internet, and the trade – by lending from banks.

According to the BNS, the methodology in the transportation and warehousing industry was revised, as a result of which in January there was an increase of 7.9% (according to the new methodology, last year the growth was +8.6%). The growth was provided by the acceleration of passenger turnover by 49.3% and the growth of passenger traffic by 32.5%. The revenues of enterprises from transportation in the first month of this year amounted to 371.5 billion tenge.

Periodic Researches

23 February 23

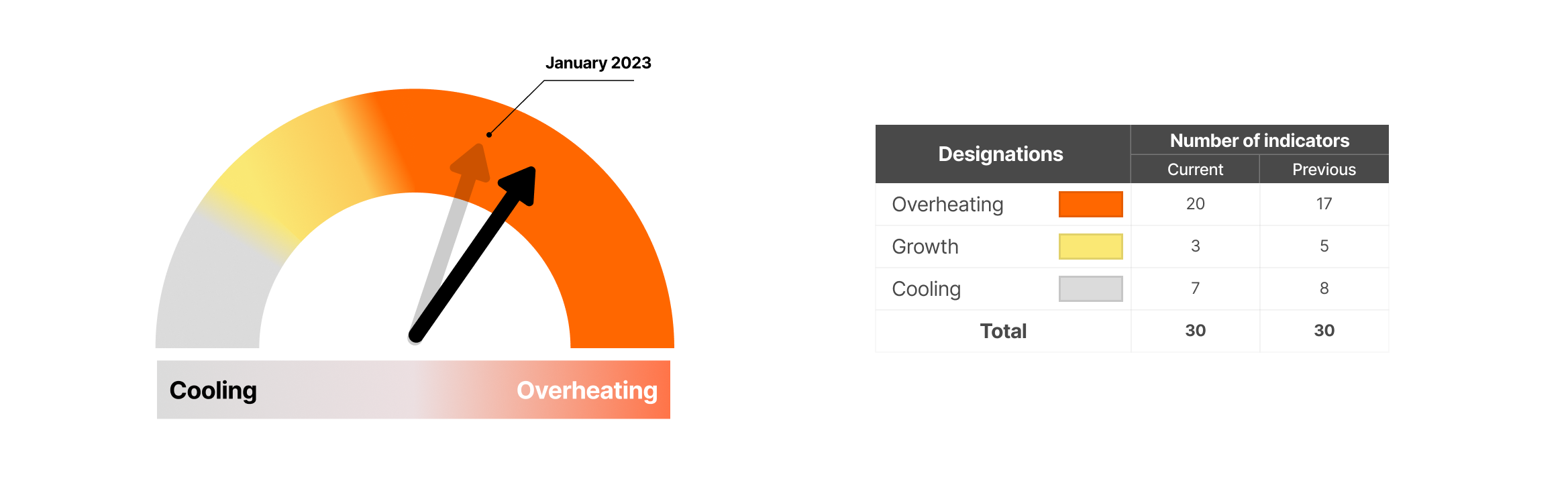

Dashboard for assessing current economic activity (02/23/2023)

According to the dashboard results for December, 20 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Compared to the previous dashboard, 1 indicator in the monetary conditions block and 2 indicators in the economic environment block have moved to the overheating zone. Due to a significant acceleration of economic activity, while maintaining a positive increase in prices, there was an increase in overheating in the economy in January 2023. This development of the economy is mostly due to the recovery growth of the sectors affected last year.

We believe that the balance of current indicators corresponds to some softening of the inflationary background due to the easing of consumer demand pressure. Unstable and high inflation expectations, the continued growth of underlying inflationary pressure and the persistence of increased fiscal incentives that largely support consumer activity explain the predominance of pro-inflationary risks. In this regard, we expect the base rate to remain at the current level and the regulator to maintain hawkish rhetoric in general even after the reversal of the inflationary trend.

Periodic Researches

31 January 23

Leading indicator of economy (results of 2022 and expectations for 2023)

The short-term economic indicator growth by the end of 2022 amounted to 3.5%. The growth rate of the short-term economic indicator showed good recovery dynamics in December (+5.1%).

Agriculture, construction and communications contributed the most to economic growth in 2022. At the same time, the industry sector had the most negative impact. Thus, there was some recovery in both the services and goods production sectors by the end of the year.

The agricultural sector grew by a record 9.1% hence one of the highest grain harvests in the last decade, which occurred by the increased state financing of harvesting operations and increased availability of agricultural machinery through leasing.

Despite the hike in prime cost, the construction industry showed an impressive increase by the end of the year and grew by 9.4%. Construction of residential buildings in 2022 increased by 13.7%, non-residential by 21.7% and structures by 9.7%. And we believe that this growth is due to the launch of major construction projects, the completion of repairs and prolonged financial promotion.

Industry became a struggling sector last year. Due to repairs at large deposits, multiple CPC shutdowns and a decrease in the supply of ferrous metals to Russia, the mining industry has been slowing down since April and decreased by 1% by the end of the year. Also during the year, oil production decreased by 1.9%, natural gas by 1%, iron ores by 20.6% and other minerals by 7.6%.

The slowing-down dynamics were noticed in the manufacturing industry, the growth rate of which decreased to 3.4% by the end of the year.

The cooling was observed in tobacco (from 9.8% according to data for 11 months to 7.9%), textile (from 8.1% to 5.3%), and metallurgical production (from 3.9% to 1.9%). In comparison with 2021, the production of furniture (-10.7%), pharmaceutical (-10.3%) and dairy (-7.1%) products also decreased.

In the service sector, good growth was seen in the communication market (+8.0%). This is due to the faster development of Internet services versus the slowdown of telephone services. Due to a cargo transportation drop of 2.8% and a slowdown in the growth rate of cargo turnover to 1.0%, the transport and warehousing industry has remained at the same level in recent months.

After slowing down in the summer-autumn period, trade continued its growth this month and grew by 5.0% at the end of the year. The growth rate of retail trade was 2.1%, and wholesale – 6.3%. The past year has changed trends within the industry under price pressure in the economy, where there was not only a reorientation of the food market to the wholesale segment but a reduction in demand for them also. At the same time, the demand for non-food products was backed by many installment programs and the growth of retail lending.

Periodic Researches

12 January 23

Dashboard for assessing current economic activity (01/12/2023)

According to the dashboard results for December, 17 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Compared to the previous dashboard, 1 indicator in the monetary conditions block and 1 in the external conditions block have moved into the cooling zone. Due to the tightening of internal monetary conditions and the mitigation of the negative impact of the external inflationary background, there is a slight weakening of the price overheating in the economy in December 2022. And we note a positive increase in economic development for the first time since the last spring.

We believe that a further increase in interest rates can only deepen stagflationary risks in the current conditions. Keeping the base rate at the current level will help maintain a balance between limiting further price growth and maintaining positive business activity dynamics.

Periodic Researches

30 December 22

Leading indicator of economy (11 months 2022)

The short-term economic indicator growth demonstrated recovering dynamics and amounted to 3.2% over the 11 months of 2022.

The recovery in growth rates is noticed in the services sector, while the goods sector continues its slowdown. There is still observing cooling in the construction and industrial sectors. A good recovery has taken place in the trade sector. And stable growth is observed in agriculture and communications.

The industrial sector is stagnating: the mining industry remains in the negative zone with a slight improvement (from -1% in 10 months to -0.9% now), and the growth of the manufacturing industry is declined from 4.3% to 4.2%. The mining sector remains problematic: crude oil (-2.2%), natural gas (-1.4%), iron ores (-20.2%) and other minerals (-8.9%). There is a slight decrease in the manufacturing sector that is due to a slowdown in the growth of tobacco production (from 12.7% to 9.8%), light (from 7.8% to 6.9%) and metallurgical (from 4.4% to 3.9% of industries.

The growth rate in the construction industry is cooling due to a decrease in the growth of construction of non-residential buildings.

At the same time, a significant growth boost occurred in the trade sector, where retail trade increased from 1.4% to 2.0% and wholesale from 5.3% to 6.0%. However, the growth of the food trade is cooling, which, in our opinion, is due to the growing inflationary pressure and the consumer purchasing power (food inflation in November +24.1%).

the transport and warehousing industry remained almost at the same level due to a drop in cargo transportation by 3.1% and a decrease in the growth rate of cargo turnover to 1.8%.

And due to a good harvest this year growth in the agricultural sector reached 8.5%. Whereas, the growth was +7.6% in the telecommunications and data trans market: Internet services continue to grow in Almaty and Astana cities.

Periodic Researches

02 December 22

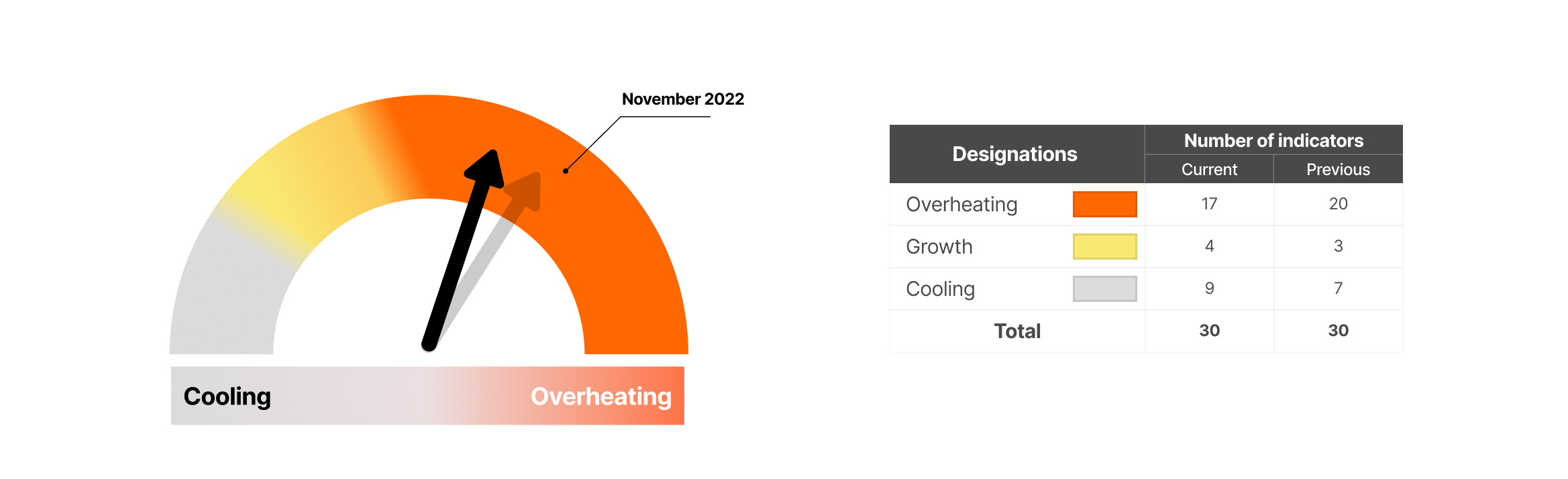

Dashboard for assessing current economic activity (12/02/2022)

According to the dashboard results for November, 20 out of 30 factors indicate an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

1 indicator in the inflation block has moved into the overheating zone in comparison with the previous dashboard. The increase in price factors overheating is getting worse, while business activity and economic growth, on the contrary, show cooling. Increasing stagflation risks are likely to be a factor in maintaining budget spending at elevated levels. In these circumstances, an excessive increase in interest rates may contribute to an additional expansion of the budget deficit, thereby complicating the ability to keep inflation under control. Given the growing risks regarding the prospects for the development of the domestic economy, the main issue in ensuring sustainable growth and stable inflation is a balanced approach to decision-making, as well as the consistency of budgetary and monetary policy measures.

Periodic Researches

30 November 22

Leading indicator of economy (10 months 2022)

As we expected, the growth of the short-term economic indicator for 10 months of 2022 continued to slow down and amounted to 3.1%. Growth for 9 months has reached 3.5%.

The decline in growth rates is observed in the sectors of production of goods and services. There is a cooling in industry, trade, transport and warehousing. At the same time, agriculture and communications have grown.

The industrial sector is slowing down: the mining industry has moved into negative territory (-1%), and the growth of the manufacturing industry has decreased from 4.6% to 4.3%. Problems are noticed in the production of crude oil (-2.5%), natural gas (-1.5%), iron ores (-18.5%) and other minerals (-9.9%).

The construction industry is returning to its potential level after the overheating previously observed in the market.

Problems in the industry also affect separate sectors in the service industry. Thus, domestic trade continued to slow down from +4.3% to +4.1%. And we believe that the slowdown is due to the increase in food prices (+23.1% YoY in October) and the high base of last year. Due to a 2.9% drop in cargo transportation and a decrease in the growth rate of cargo turnover from 3.0% to 2.5%, growth cooled from 4.8% to 3.9% in transport and warehousing.

At the same time, the growth of the agricultural sector reached 8.2% due to a good harvest.

The telecommunication market shows advanced development (+7.1%). This is due to the growth of Internet services in Almaty and Astana cities.

Periodic Researches

19 October 22

Leading indicator of economy (9 months 2022)

The growth of the short-term economic indicator continues to slow down from +3.7 in the first 8 months of 2022 to +3.5% for 9 months

A decrease in growth rates is observed in 4 out of 6 sectors of the economy: industry, construction, trade, transport and warehousing.

The slowdown affected manufacturing and mining in the industry sector. The latter remained at the level of last year due to problems in the oil and gas industry and metallurgy. Oil production declined due to repairs at Kashagan and Tengiz, while metal production sank due to problems with the supply of iron ores to Russia.

In our opinion, the slowdown in construction is due to the hikes for building materials, a decrease in investment in housing construction, and the completion of major government projects.

At the same time, the issues of the real sector also affect the service sector, where there is a decline in trade, transport and warehousing. The observed weakening of domestic trade growth from +5.2% to +4.3% is probably due to both rising food prices (+22.2% YoY in September) and the fading away of the positive shock of trade with the Russian Federation. Although food sales are growing in monetary terms, they are declining in physical volumes. And on the contrary, in wholesale trade there is an increase in sales of food products, which may indicate a reorientation of the trade market more to the wholesale segment.

Periodic Researches

29 September 22

Leading indicator of economy (8 months 2022)

According to the latest data, the growth of the short-term indicator is slowing down: from +6.5% at the end of the 1st quarter to +3.7% in 8 months).

The main sectors of the economy continue to grow compared to last year, but there is a slowdown in the largest ones – industry and trade in comparison with previous months.

In industry, mining which is the key sector harms the growth rate. This is due to the shutdown of oil production upon unscheduled repairs at Kashagan and planned ones at Tengiz, as well as due to constant interruptions in the operation of the largest pipeline of the Caspian Pipeline Consortium (CPC), through which most of the extracted oil is exported. However, if earlier the extraction of metal ores could partially offset the problems of the oil and gas sector, now certain problems are present here.

So, according to the latest data, ore mining is slowing down. Such stagnation, in our opinion, is associated with a significant decline in the supply of ferrous metals, iron ores and concentrates from Kazakhstan to Russia. Mining of iron ores fell by 15.5%.

The observed weakening of domestic trade growth from 6.2% to 5.2% is due to rising food prices (+20.8% YoY in August) and worsening inflation expectations. All this leads to the fact that people give much more money for products, respectively, their consumption begins to decrease.

Therefore, although food sales are growing in monetary terms, they are declining in physical volumes.

At the same time, in wholesale trade, on the contrary, there is an increase in sales of food products, which may indicate a reorientation of the trade market to the wholesale segment.

Periodic Researches

02 September 22

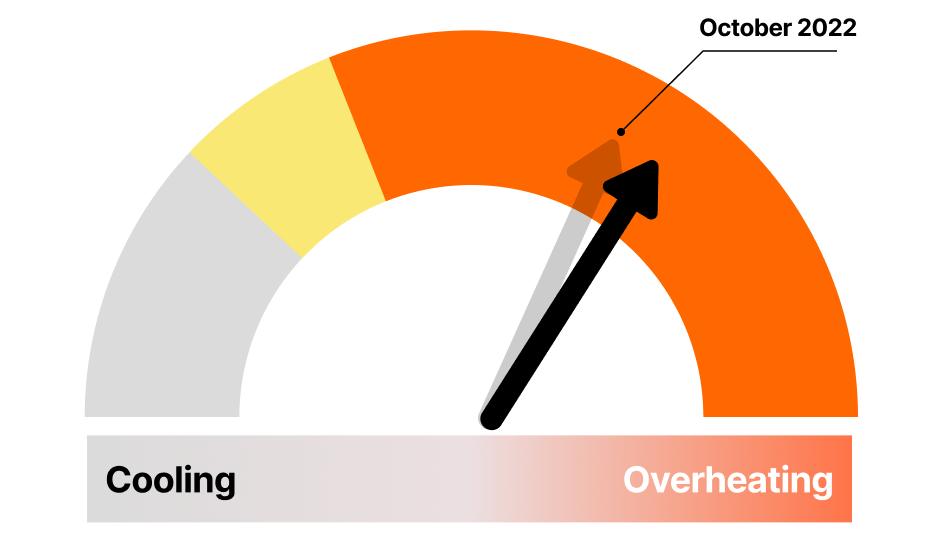

Dashboard for assessing current economic activity (09/02/2022)

According to the results of the developed dashboard, 22 out of 29 factors indicate a steady overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external terms. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

1 indicator in the inflation block and 2 in the monetary terms block have moved into the cooling zone compared to the previous dashboard. However, the increased overheating in the previously observed indicators brings the attention of the Government and the National Bank of the Republic of Kazakhstan to continue assuming measures to stabilize the situation. We expect a further increase in the base rate at the next meeting of the National Bank of the Republic of Kazakhstan Monetary Policy Committee.

Periodic Researches