Publications by topic Inflation

09 August 23

Monetary conditions (May 2023)

According to RMCI dynamics, there is a further monetary ridigity strengthening in May 2023. The Index components have an undirectional effect on prices, while the main contribution to the monetary conditions tightening is made by the exchange rate component. And both RMCI Index components began to deviate more strongly from their equilibrium value following May 2023 results.

Despite the increasing transition of the real interest rate to the zone of positive values, provided by the weakening of price pressure while maintaining the NBK base rate at 16.75%, it has a weak deterrent effect on household consumption behaviour.

Firstly, the household decisions to save or spend come from their inflation expectations, which by the end of May 2023 were higher than the actual dynamics of price growth (17 vs. 15.9) and reflect the intuitive expectations of economic agents of further inflation growth due to the influence of price conjuncture in the housing and fuel markets. Secondly, the availability of consumer credit, as well as active fiscal leverage increases incentives to keep consumer demand excessive, which continues to create an imbalance in market forces.

The continued expansion of the positive gap in the real effective exchange rate of tenge that was provided by a high base rate leads to an increase in the restraining effect of monetary conditions on the import component of prices. Thus, the main influence of monetary conditions is mostly expressed in the control of the external component of consumer inflation. While measures aimed at limiting domestic price pressure do not work due to the inconsistency of macroeconomic policy measures and the weakness of the percentage channel of the monetary policy transmission mechanism.

Periodic Researches

ConsumptionBase RateInflationAizhan Alibekova

06 April 23

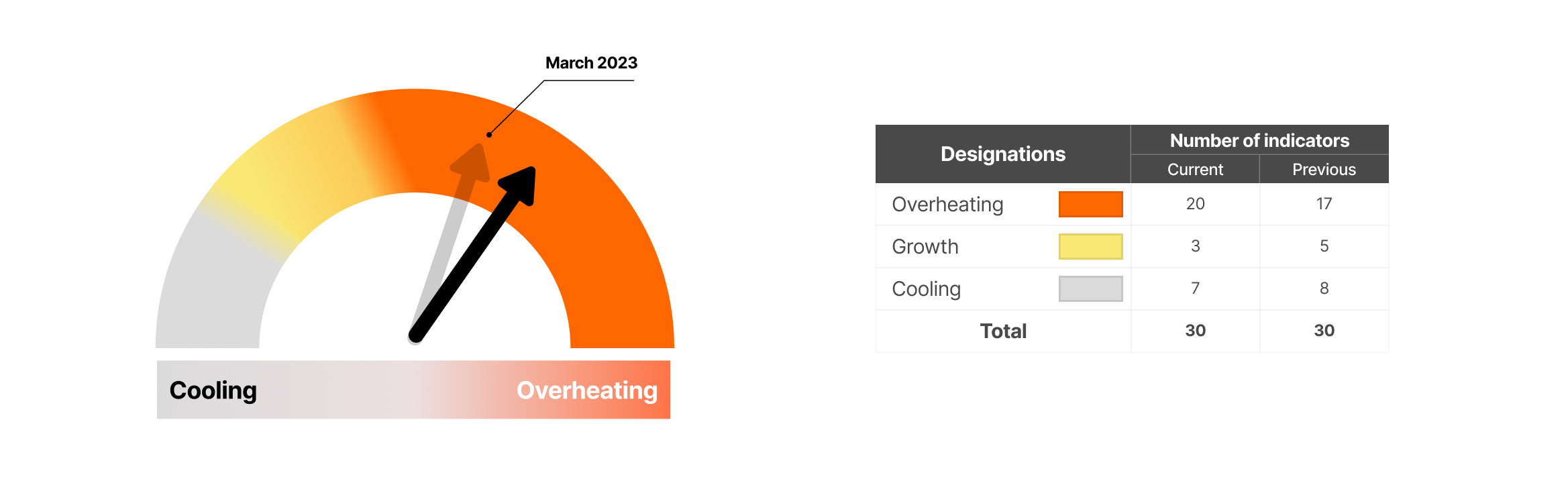

Dashboard for assessing current economic activity (04/06/2023)

According to the dashboard results for December, 21 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Thus,2 indicators in the monetary conditions block and 1 indicator in the economic environment block have crossed the overheating zone compared to the previous dashboard. We also note an improvement in business activity while reducing the increase in consumer prices in March. Inflation rates fell due to the technical effect of a high base, without identifying other fundamental factors that could have a disinflationary effect. At the same time, the risks of inflationary environment deterioration have significantly increased that are related to the allocation of additional funds to support business activity, which for the most part causes excessive demand, as well as imbalances accumulated over the years of administrative restrictions in the housing and utility services and fuel market.

So, in terms of growing business activity, prolonged geopolitical risk, mini-crises in the US and EU banking systems and the deterioration of prerequisites for the inflationary processes, the regulator will continue its hawkish policy till the middle of the year, which determines our expectations for maintaining the base rate at the same level at the upcoming meeting – 16.75%.

Periodic Researches

31 March 23

Monthly review of the economic climate and Jusan Analytics outlooks (March 2023)

We have published our vision of the development of the macroeconomic situation and forecasts for the key economic indicators.

The risk map area has expanded compared to last month due to the destabilization of the global financial sector. At the same time, there is a systematic reduction in the economic risks that have dominated the past year, such as inflation and supply chain disruption.

The current situation with Western banks leads to an increase in the risk premium on loans and the stock market. This situation is a natural result of the implementation of strict measures on monetary policy and improper risk management of several banks and not a systemic financial crisis.

Kazakhstan's economy is showing good growth rates. The expansion of fiscal stimulus, stabilization in the mining industry and the expected easing of price pressure were factors in the revision of GDP growth outlooks from 3.8-4.3% to 4.0-4.5%. At the same time, we note a steady overheating in the economy due to excessive demand stimulation. On the one hand, this leads to high GDP growth values, and on the other hand, it affects the preservation of inflation and the maintenance of high values of the base rate.

The weakening of external inflationary pressure, a stable exchange rate and the long-term maintenance of restraining monetary conditions that limit consumer activity, together with the weakening of risks from inflation expectations, caused the revision of the future dynamics of consumer inflation forecasts. According to our new baseline scenario, inflation will decrease to 13.4% (the previous estimate is 15.1%). The outlook for the tenge exchange rate provides for its weakening to 477 tenge per US dollar by the end of the year, and at the level of 456-466 in April.

Periodic Researches

GDPExchange RateBase RateInflationJusan Analytics

29 March 23

Price barometer (February 2023)

Risks and prospects

Global inflation remains high, although it has probably already passed its peak in most developed countries. The IMF experts expect that the inflationary environment will improve in 2023, even if core inflation, which does not include more volatile energy and food prices, has not yet peaked in many countries. At the same time, a geopolitical turbulence factor causes risks of a long period of increased inflation.

Following our baseline scenario, the internal inflationary pressure will weaken in 1 year but will remain significantly above the NBK target. This is due to several factors. The long-term maintenance by the regulator of restraining monetary conditions is already showing its effect on weakening consumer demand, slowing price growth and reducing inflation expectations of economic agents. And the increase in wages at the beginning of the year, the indexation of pensions and benefits, and the next fiscal impulse restrain the decline in real incomes as well as all of these complicate the possibilities of managing inflationary risks.

An additional stabilizing contribution is made by the exchange rate dynamics of the tenge, which allows it to restrain the risk-taking of inflation growth through the cost of imported goods and limits the possible increase in the volatility of inflation expectations.

The expansion of fiscal stimulus due to the revision of the transfer volume from the National Fund, which contributes to the consumer demand expansion, has caused a change in our estimates of the prospects for economic growth. Thus, the updated forecasts assume a GDP growth of 4.0-4.5% in 2023 and a 3.1% of the output gap. Inflation will enter a downward trajectory and will be at a 12.4–14.3% level by the end of the year. And monetary conditions as a whole will remain close to neutral.

The observed degree of heterogeneity of the response of inflationary processes in response to monetary policy shocks, unstable inflationary expectations and high pro-inflationary risks determine our expectations for a further smooth reduction of the NBK base rate.

Periodic Researches

InflationAizhan Alibekova

23 February 23

Price barometer (January 2023)

Risks and prospects

- The balance of inflation risks remains biased in favour of inflation despite a moderate slowdown in the overall growth rate of consumer prices over the past 4 months.

- And despite their decrease in January (this is a common situation that happens every year, and since February they have been growing again as usual) increased household inflation expectations, as well as the continued growth of the underlying inflationary pressure, are factors that require maintaining the base rate at the current level and maintaining hawkish rhetoric even after the reversal of the inflationary trend. At the same time, since the actual increase in inflation corresponds to the forecasts of the regulator, we regard the probability of a further increase in the base rate as minimal.

- The heterogeneity of the dynamics of prices for market services with the continuing fiscal incentives may adversely limit the amplitude of the future decline in inflationary pressure and contribute to a longer period of high prices.

- The cooling of consumer activity since the end of 2022, caused by a prolonged decline in household real incomes, the continuing rise in consumer prices and restraining monetary conditions, contributes to the cooling of inflationary pressure.

- According to our forecasts, inflation during the first quarter of 2023 will continue to accelerate and will peak at 21.0-22.0% annually. And prices will decrease if there are no additional external and internal growth triggers.

- Revised forecast values of future price growth dynamics will be presented “Price Barometer” for February 2023. Improving the forecasts of Jusan Analytics will mean that we identify stable signs of an improvement in the inflationary environment.

Periodic Researches

InflationAizhan Alibekova

23 February 23

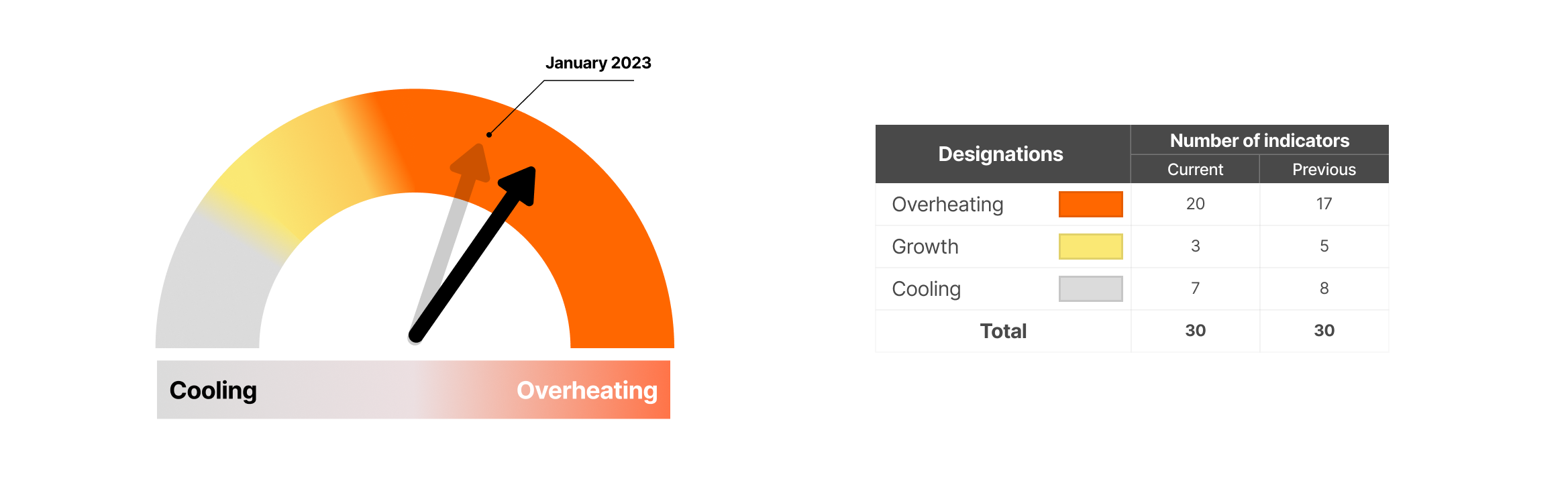

Dashboard for assessing current economic activity (02/23/2023)

According to the dashboard results for December, 20 out of 30 factors show an overheating of the economy. The analysis was carried out in 4 blocks: inflation, monetary, economic and external conditions. A semantic analysis of the National Bank of the Republic of Kazakhstan press release was also carried out.

Compared to the previous dashboard, 1 indicator in the monetary conditions block and 2 indicators in the economic environment block have moved to the overheating zone. Due to a significant acceleration of economic activity, while maintaining a positive increase in prices, there was an increase in overheating in the economy in January 2023. This development of the economy is mostly due to the recovery growth of the sectors affected last year.

We believe that the balance of current indicators corresponds to some softening of the inflationary background due to the easing of consumer demand pressure. Unstable and high inflation expectations, the continued growth of underlying inflationary pressure and the persistence of increased fiscal incentives that largely support consumer activity explain the predominance of pro-inflationary risks. In this regard, we expect the base rate to remain at the current level and the regulator to maintain hawkish rhetoric in general even after the reversal of the inflationary trend.

Periodic Researches

20 February 23

Price barometer (December 2022)

Risks and prospects

- The CPI inflation growth rate in the last month of 2022 surprised us with the uncharacteristic slowdown in consumer price growth rates in December.

- The declining volume of the household’s real incomes probably contributed to a more restrained household consumer demand in December, despite its usual growth on the eve of the preparations for the New Year.

- The observed slowdown in price growth is not a sign of an inflationary cooling yet. The continued acceleration of core inflation indicators and the deterioration of inflation expectations are signals of a long-term trend of higher prices and different rates with directions of prices of consumer goods and services.

- Entered into force on January 1, 2023, new values of the key calculated indicators may give an additional short-term inflationary impulse due to an increase in the household’s nominal income.

- According to our forecasts, inflation in annualized terms will continue to accelerate during the first quarter of 2023. And in the future, prices will slowly decline if there are no additional growth triggers.

- Following the estimates, the current high inflation and the restraining monetary conditions supported by the regulator will reduce the consumer spending plans of all economic agents during the first half of the year.

- We expect a slowdown in price growth in annualized terms to 14.2-16.8% by the end of 2023, which will be mostly explained by the maintenance of monetary conditions close to restraining, the technical effect of the high base of last year, as well as the gradual mitigation of impacts of the excessive demand and lack of supply in the domestic market.

- Potential price spikes for the production, purchase and logistics of goods caused by external factors with new geopolitical threats are still among the key risks and may contribute to maintaining increased rates of price growth in the coming months of 2023.

Periodic Researches

InflationAizhan Alibekova

17 February 23

Monetary conditions (December 2022)

Monetary conditions tightened somewhat and became more disinflationary in December 2022. This happened while simultaneously REER forming at a level above its potential and reducing the negative gap in the real interest rate. The value of the RMC Index is in the zone of restraining monetary conditions and close to the neutral zone border.

The REER value for the period under review remained at the level of November 2022, which was facilitated by the continued favourable terms of trade. The trend of the REER strengthening observed in the last 5 months of 2022 should limit the price competitiveness of Kazakhstan producers in foreign markets. However, the periodic shortage in certain commodity markets due to geopolitical tensions reduces the possible negative effect on Kazakhstan’s export revenue. A slight reduction of the positive gap in the exchange rate component is a positive trend since this fact corresponds to a gradual correction of the REER value from its significant overestimation to a more fundamentally determined equilibrium value.

At the same time, the interest component gap was closer to 0, and the real interest rate was less negative. This is due to the base rate increase of 75 bps in early December and, contrary to the shock measures taken by the regulator in November 2022, a deterioration in inflation expectations, as well as an increasing excess of tenge liquidity by fiscal measures to support economic activity.

Periodic Researches

ConsumptionBase RateInflationAizhan Alibekova

02 February 23

Monetary conditions (November 2022)

In November 2022, the monetary conditions continued to slightly tighten. This was due to the REER formation at a level above its potential with the continued strengthening of the real effective exchange rate of tenge, as well as the reduction of the negative gap in the real interest rate.

The RMCI value has moved into the zone of restraining monetary conditions for the first time since May 2022. Taking into account the NBK's latest rhetoric on a clear intention to complete the cycle of rate hikes, the impact of the interest component in the short term (until inflation moves into a downward trend) will have an effect close to neutral. As inflation declines, as well as if the positive gap in the REER remains, monetary conditions will be restraining closer to neutral, so as not to suppress business activity and cool the increased inflationary background.

The components of the Monetary Conditions Index continue to have conflicting effects on inflationary processes and economic prospects. The exchange rate component restricts them, while interest rates have a more stimulating effect on business activity growth and weakly limit consumer and investment demand.

Periodic Researches

ConsumptionBase RateInflationAizhan Alibekova